NVIDIA 下调19Q4 Guidance,2月14日举行Q4财报

本文地址:http://www.moepc.net/?post=5169

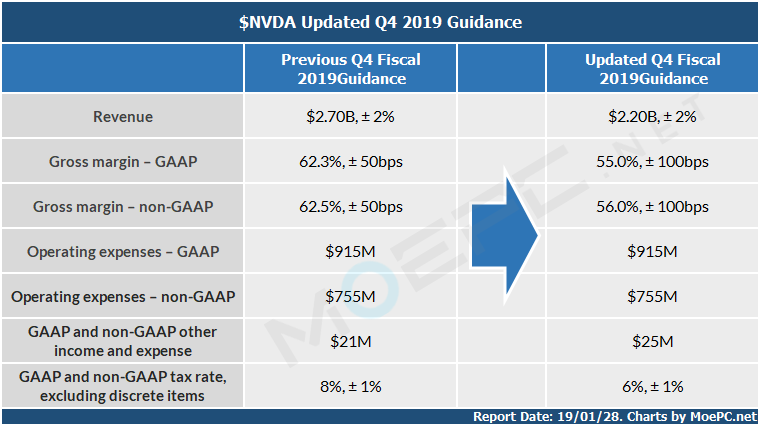

NVIDIA 今日宣布大幅下调2019财年第四季度预期,Q4 预计营收由$2.7B 下调18.5% 至$2.2B,原本Q4预期相比18Q4就已经有下降。

同时毛利率也从62.5% 下调至 56.0%。【非GAAP】

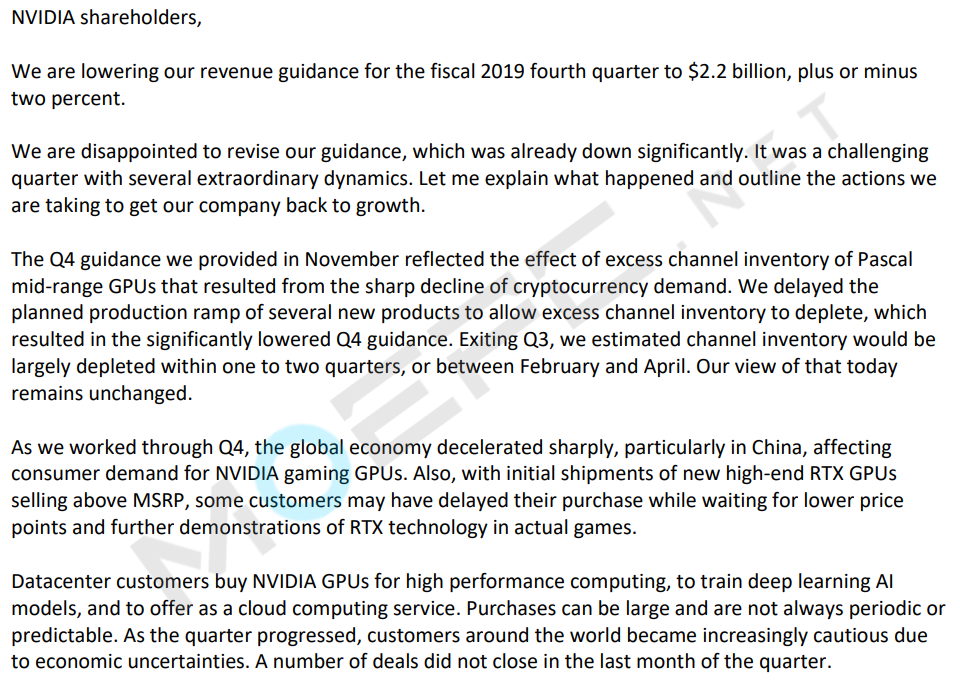

据CEO 黄仁勋在给持股者的一封信中解释道,主要是由于中端Pascal GPU【1060】存货过多,以及挖矿需求减退。NV 推迟了新品Turing 显卡的生产来清库存。NV预计2月至4月间才能清掉大部分Pascal 库存。

当然还有一部分责任推给了全球经济减退(信中特别指出中国)影响了消费者对NV 游戏GPU的需求。数据中心客户在采购GPU时也更加谨慎。

Turing RTX GPU 售价过高也是原因之一。

因此在游戏市场和数据中心市场的销售均未达到预期。

PR原文:

- Fourth quarter revenue expected to be $2.20 billion versus previous guidance of $2.70 billion

- Gaming and Datacenter revenue below company’s expectations

- Management to discuss reported financial results on Feb. 14 earnings call

NVIDIA today updated its financial guidance for the fourth quarter of fiscal year 2019, reflecting weaker than forecasted sales of its Gaming and Datacenter platforms.

In Gaming, NVIDIA’s previous fourth-quarter guidance had embedded a sequential decline due to excess mid-range channel inventory following the crypto-currency boom. The reduction in that inventory and its impact on the business have proceeded largely inline with management’s expectations. However, deteriorating macroeconomic conditions, particularly in China, impacted consumer demand for NVIDIA gaming GPUs. In addition, sales of certain high-end GPUs using NVIDIA’s new Turing? architecture were lower than expected. These products deliver a revolutionary leap in performance and innovation with real-time ray tracing and AI, but some customers may have delayed their purchase while waiting for lower price points and further demonstrations of RTX technology in actual games.

In Datacenter, revenue also came in short of expectations. A number of deals in the company’s forecast did not close in the last month of the quarter as customers shifted to a more cautious approach. Despite these near-term headwinds, NVIDIA has a large and expanding addressable market opportunity in AI and high performance computing, and the company believes its competitive position is intact.

“Q4 was an extraordinary, unusually turbulent, and disappointing quarter,” said Jensen Huang, founder and CEO of NVIDIA. “Looking forward, we are confident in our strategies and growth drivers.

“The foundation of our business is strong and more evident than ever ? the accelerated computing model NVIDIA pioneered is the best path forward to serve the world’s insatiable computing needs. The markets we are creating ? gaming, design, HPC, AI and autonomous vehicles ? are important, growing and will be very large. We have excellent strategic positions in all of them,” he said.

NVIDIA expects its GAAP and non-GAAP gross margin to be impacted by approximately $120 million in charges for excess DRAM and other components associated with the updated revenue guidance and current market conditions.

The company will provide Q4 fiscal 2019 financial results and Q1 fiscal 2020 guidance on its earnings call scheduled for Feb. 14.

This update is an estimate, based on information available to management as of the date of this release, and is subject to further changes upon completion of the company’s standard quarter and year-end closing procedures. This update does not present all necessary information for an understanding of NVIDIA’s financial condition as of Jan. 27, 2019, or its results of operations for the quarter and fiscal year ended Jan. 27, 2019. As NVIDIA completes its year-end financials close process and finalizes its financial statements for the quarter and year ended Jan. 27, 2019, it will be required to make significant judgments in a number of areas. It is possible that NVIDIA may identify items that require it to make adjustments to the financial information set forth above and those changes could be material. NVIDIA does not intend to update such financial information prior to release of its fourth quarter and year-end financial statement information, which is currently scheduled for Feb. 14, 2019.

本文地址:http://www.moepc.net/?post=5169

via:nvidia

MOEPC.NET编辑,转载请保留出处。

我只想等REN2的U,等U出来,2060价格也该稳定了

接下来就是等AMD的财报了

DXR,DLSS游戏寥寥可数,传统性能价格比一点没提升,步伐过大扯到蛋。

Intel除了CPU以外的业务都不算差,CPU进入颓势也不会有多大问题;农企就不说了,这么多年都是一个拉另一个坚持下来的;NV看上去业务很多,但是几乎每一个业务都离不开他的GPU,以及CUDA。一旦GPU出现意料之外的问题,直接会影响整个公司。

另外,天朝人民家中坐,无端大锅美帝来。

@7万钣金中里毅:消费升级,指榨菜热销

游戏市场,1060提前挤出了中端玩家的油水,高端网吧(除了极其个别的营销策略)基本不会拥抱这一代的RTX,只能寄希望于有信仰的粉丝承担RTX20系的销售重担。HPC这部分反而乐观,毕竟2019年amd、intel都拿不出高性能HPC用GPU,更别提还占着CUDA的茅坑。AI却是一个定时炸弹,几大厂商都转而开发自家芯片,在这个市场上绿厂和alphabet、Amazon甚至华为比起来,投入还是不够的

588库存问题不比1060严重了,也没见苏妈因为这个哭天喊地……

网吧都大出血上1060了。。。

这是靠着热门游戏榨出市场最后价值了吧。

老黄干脆自己开发游戏吧。

呵呵,自己订的价,心里没点逼数? 还怪消费者不买,前几代千元能买到X04芯片的甜品,现在两千元才能买到X06芯片的阉割货,黄奸商还能更无耻些么?

@飞轮饼:2060的TU106还是个阉割货,简直不能忍

一个是定价增速远超国内薪资增速加上经济遇冷,一个是挖矿后遗症,前者AMD和英特尔三家都有影响,后者AMD应该好点,单看Mindfactory CPU销售还算不错,美亚印象中best seller zen当时top10就一个1700,现在加上epyc的持续发酵,个人感觉AMD Q4也会下跌,但是欧美区CPU和epyc的上升抵消国内的下跌,真赚大钱要到估计年底或明年了

当然还有一部分责任推给了全球经济减退(信中特别指出中国)影响了消费者对NV 游戏GPU的需求。数据中心客户在采购GPU时也更加谨慎。

呵

算了懒得说