AMD 2017 Q4 ER 信息: Zen 2架构EPYC 和7nm Vega 今年出样,提升显卡产量,以及架构层面安全增强【附PPT & 英文原文】

本文地址:http://www.moepc.net/?post=4250

财报内容本身比较枯燥,不过有几点新的信息挺重要的。

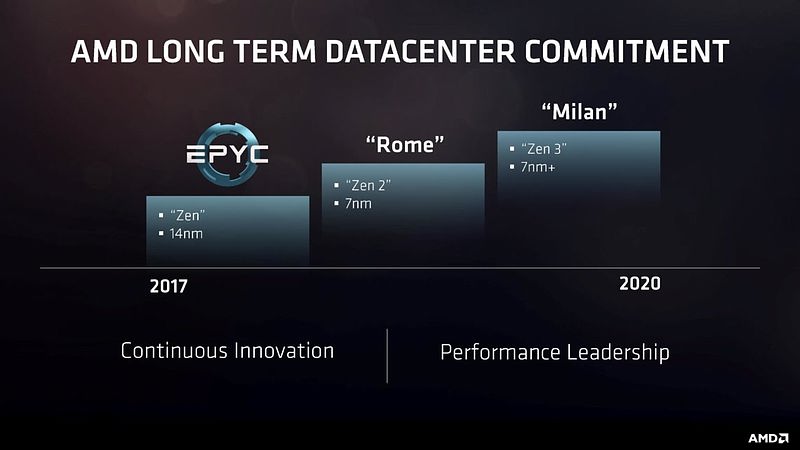

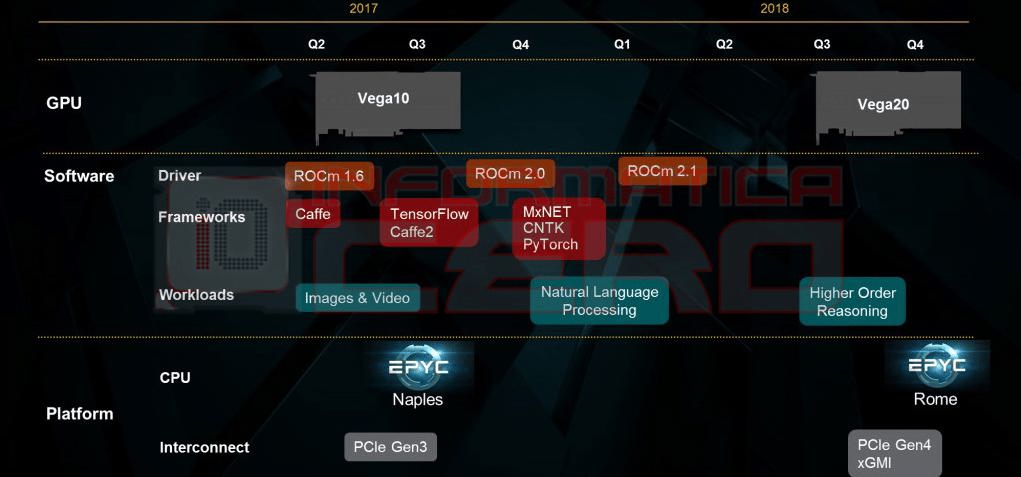

AMD会在2018年与主要的云服务商和OEM进一步合作,增加第一代EPYC的应用,并完成第二代 Zen 2架构EPYC设计的关键里程碑。

Zen 2 架构设计已经完成,这点我们已经知道,不过Lisa Su说2018年晚些时候出样采用7nm制程、基于Zen 2架构的 EPYC 服务器处理器”Rome”。

首代Zen架构是桌面市场打头,Zen 2则会先登陆服务器市场。今年的桌面市场有12LP的Zen +,个人估计桌面版Zen 2要到2019了。

关于Zen 2 EPYC的传闻:

【Rumor】AMD下代服务器CPU – “Rome”将有64核心,256MB L3,128条PCIe 4.0?

此前流传的路线图

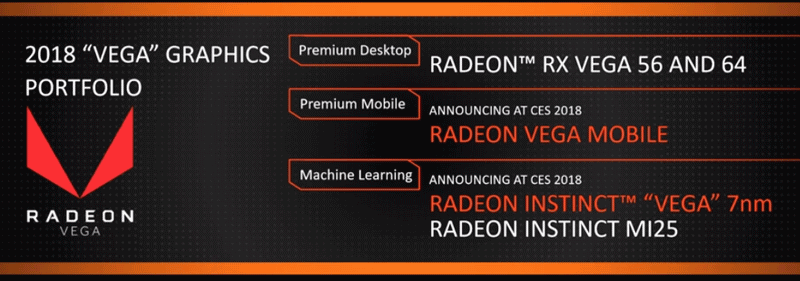

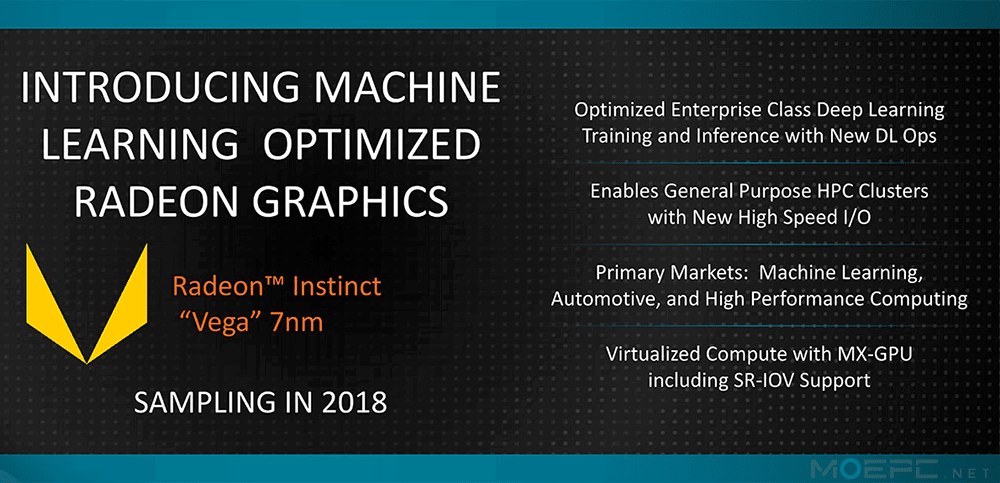

供深度学习用途的7nm Vega也是今年晚些时候出样,CES上有发表。

针对挖狂潮和显卡短缺,Lisa Su称,GPU渠道 “比预期的要低”,正在提升产量。显卡短缺不是因为缺GPU,而是因为显存的短缺,包括GDDR5和HBM2。

Meltdown和Spectre variant 1并不影响AMD。尽管spectre variant 2对AMD影响也很小,不过AMD还是提供了补丁。对后几代的CPU核心做了改动,从Zen 2开始,后面的架构将修复Spectre这样的漏洞。

Vega Mobile独立GPU的发布,进入高端笔记本市场

预计2018年会发布60+个Ryzen OEM 设备,应该是包括了台式、笔电和AIO的。

其余的大部分信息都已经在CES的发布上说过了。

本文地址:http://www.moepc.net/?post=4250

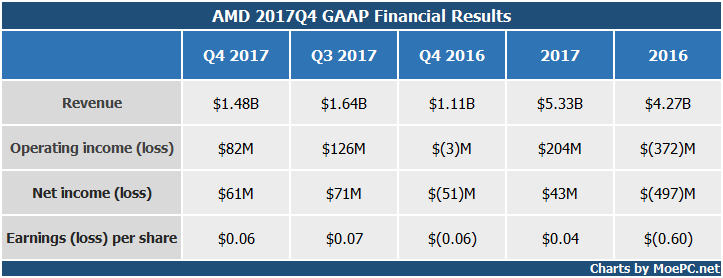

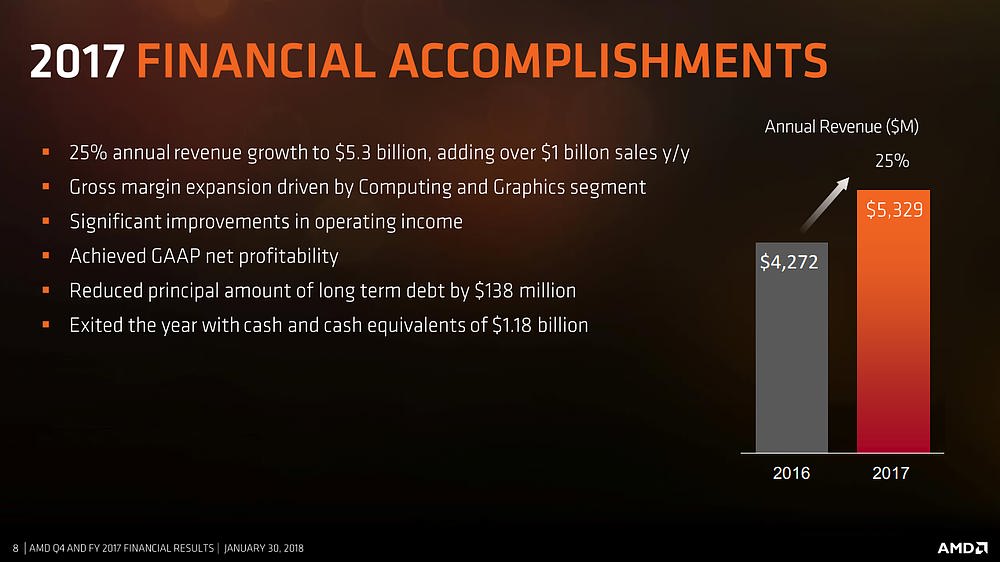

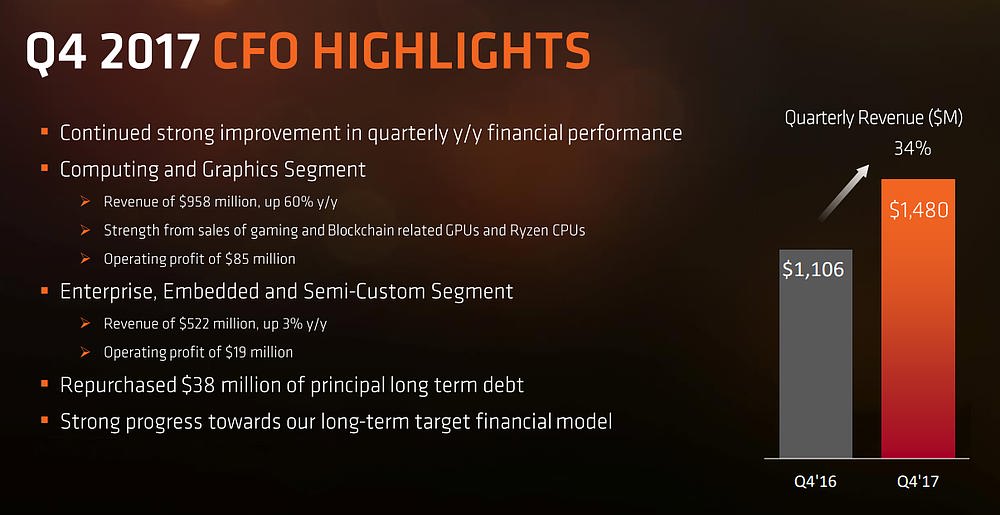

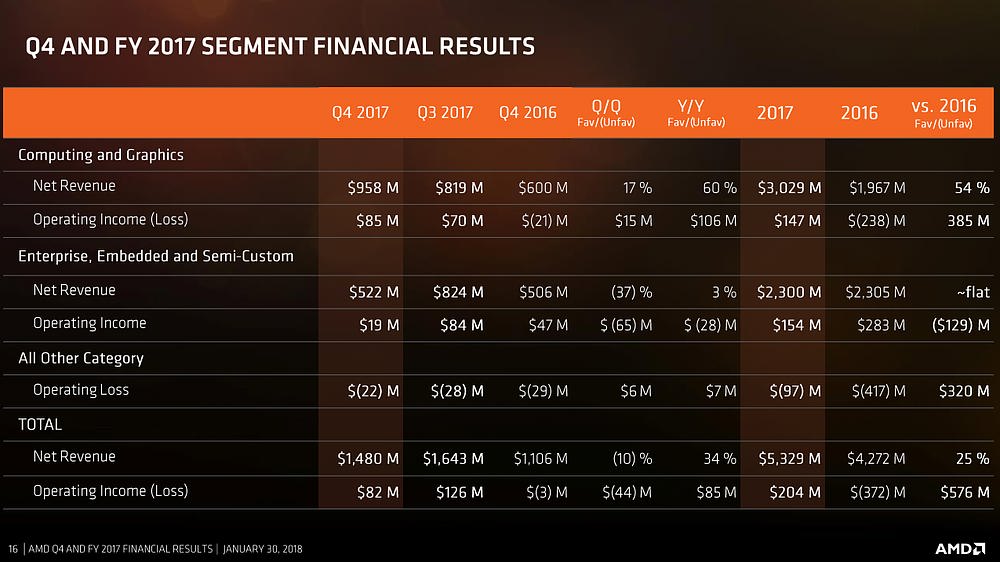

AMD以好成绩结束了2017财年,盈利超出了初步预计。Q4收入同比增长了34%,达到了14.8亿美元,而毛利率也保持了上季度达成的35%,正好维持盈利。Q4营收为8200万美元,高于去年同期的营亏300万美元。净收入为6,100万美元,也比一年前净亏损5,100万美元要好。每股收益在0.06美元。

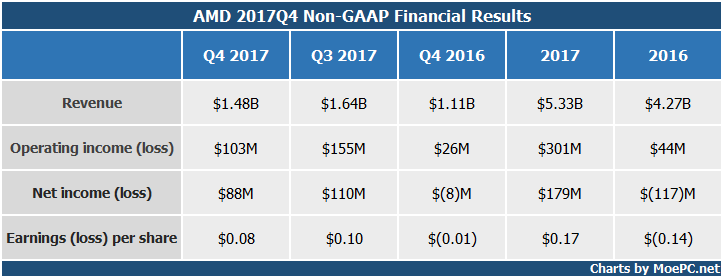

AMD还报告了非GAAP的结果,通常表明了大笔减记后的基本业务表现,但Q4非GAAP的结果与GAAP表现非常相近,因为没有晶圆协议或其他大额开支。Q4的非GAAP主要是去掉了2100万的股票分红。按非GAAP计算,Q4营收为1.03亿美元,净收入8800万美元,每股收益为0.08美元。

2017年全年收入为55.3亿美元,比2016年增长25%,总体毛利率为34%。营收2.04亿美元,2016年是亏损3.72亿美元。净收入为4300万美元,相比之下2016年全年亏损为4.97亿美元。

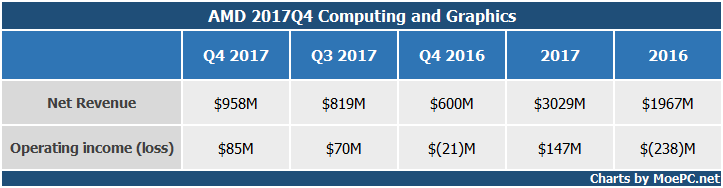

AMD的增长主要来源于计算和图形部门,实属意料之中。不仅发布了颇受好评的Ryzen CPU系列,伴随虚拟货币的爆发也卖出了生产的绝大部分GPU。计算与图形部门Q4营收为9.58亿美元,比去年同期增长了60%。营业收入为8500万美元,好于一年前2100万美元的亏损。

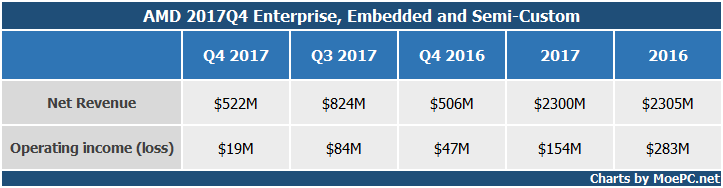

企业,嵌入式和半定制部门本季度收入5.22亿美元,比上年同期增长3%,AMD说这是服务器贡献的。营业收入为1900万美元,低于一年前的4700万美元。

其余所有的营业亏损为2200万美元,与2016 Q4的亏损2900万美元相比有所改善。

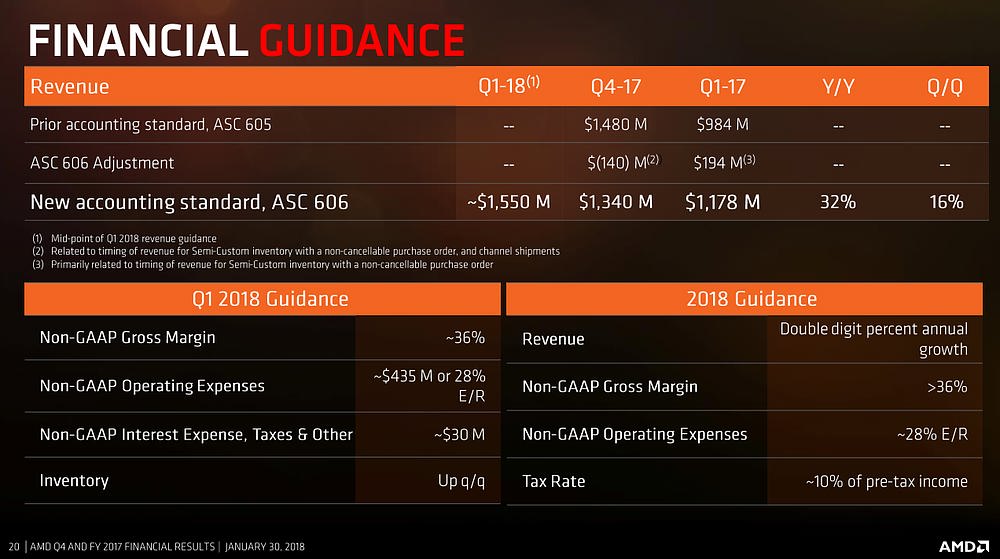

预计AMD 2018 Q1 收入15.5亿美元,上下浮动5000万美元。

本文地址:http://www.moepc.net/?post=4250

PPT:

本文地址:http://www.moepc.net/?post=4250

原文:

AMD Reports Fourth Quarter and Annual 2017 Financial Results

Fourth quarter revenue grew 34 percent year-over-year; annual revenue increased 25 percent

SANTA CLARA, Calif., Jan. 30, 2018 (GLOBE NEWSWIRE) — AMD (NASDAQ:AMD) today announced revenue for the fourth quarter of 2017 of $1.48 billion, operating income of $82 million and net income of $61 million or diluted earnings per share of $0.06. Non-GAAP(1) operating income was $103 million, non-GAAP(1) net income was $88 million and non-GAAP(1) diluted earnings per share was $0.08.

For fiscal 2017, the Company reported revenue of $5.33 billion, operating income of $204 million and net income of $43 million or diluted earnings per share of $0.04. Non-GAAP(1) operating income was $301 million, non-GAAP(1) net income was $179 million and non-GAAP(1) diluted earnings per share was $0.17.

GAAP Financial Results

Q4-17 Q3-17 Q4-16 2017 2016

Revenue $1.48B $1.64B $1.11B $5.33B $4.27B

Operating income (loss) $82M $126M $(3)M $204M $(372)M

Net income (loss) $61M $71M $(51)M $43M $(497)M

Earnings (loss) per share $0.06 $0.07 $(0.06) $0.04 $(0.60)

Non-GAAP Financial Results(1)

Q4-17 Q3-17 Q4-16 2017 2016

Revenue $1.48B $1.64B $1.11B $5.33B $4.27B

Operating income $103M $155M $26M $301M $44M

Net income (loss) $88M $110M $(8)M $179M $(117)M

Earnings (loss) per share $0.08 $0.10 $(0.01) $0.17 $(0.14)

“2017 marked a key inflection point for AMD as we re-shaped our product portfolio, delivered 25 percent annual revenue growth, expanded gross margin and achieved full-year profitability,” said Dr. Lisa Su, AMD president and CEO. “We are even more excited about 2018 as we launch our next wave of high-performance products and continue to position AMD as one of the premier long-term growth companies in the technology industry.”

Q4 2017 Results

Revenue of $1.48 billion was up 34 percent year-over-year, primarily driven by strong sales of Radeon? graphics and Ryzen? processors. Revenue was down 10 percent sequentially, primarily driven by seasonally lower sales of semi-custom SoCs.

Gross margin was 35 percent, up 3 percentage points year-over-year and flat sequentially.

On a GAAP basis, operating income was $82 million compared to an operating loss of $3 million a year ago and operating income of $126 million in the prior quarter. The year-over-year increase was primarily due to higher revenue from the Computing and Graphics segment, while the sequential decrease was primarily due to seasonally lower Enterprise, Embedded and Semi-Custom segment revenue. Net income was $61 million compared to a net loss of $51 million a year ago and net income of $71 million in the prior quarter. Diluted earnings per share was $0.06 compared to a loss per share of $0.06 a year ago and diluted earnings per share of $0.07 in the prior quarter.

On a non-GAAP basis, operating income was $103 million compared to operating income of $26 million a year ago and $155 million in the prior quarter. The year-over-year improvement was primarily due to higher revenue from the Computing and Graphics segment, while the sequential decrease was primarily due to seasonally lower Enterprise, Embedded and Semi-Custom segment revenue. Net income was $88 million compared to net loss of $8 million a year ago and net income of $110 million in the prior quarter. Diluted earnings per share was $0.08 compared to a loss per share of $0.01 a year ago and diluted earnings per share of $0.10 in the prior quarter.

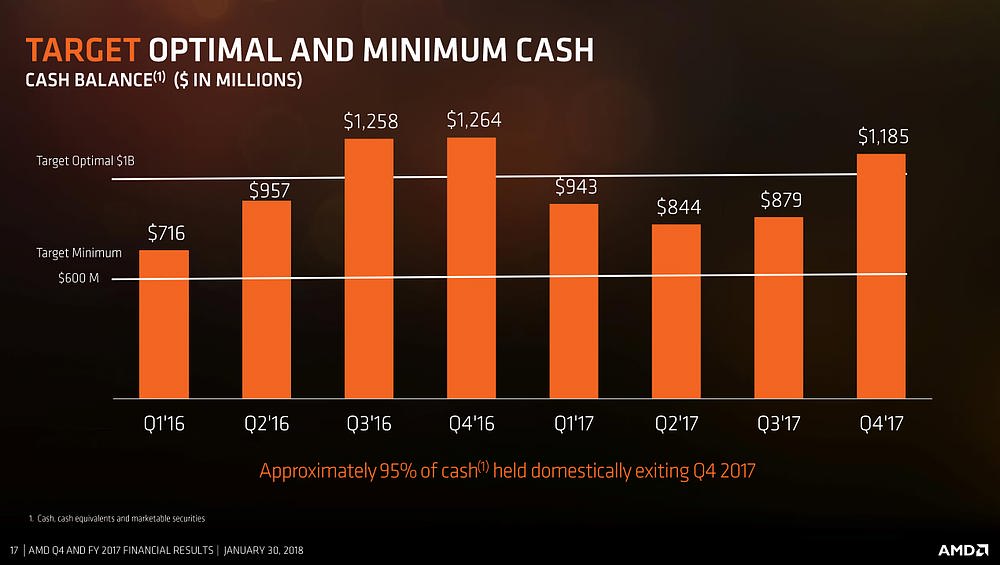

Cash and cash equivalents were $1.18 billion at the end of the quarter, up $306 million from the end of the prior quarter.

2017 Annual Results

Revenue of $5.33 billion, up 25 percent on an annual basis, was driven by an increase in the Computing and Graphics segment.

On a GAAP basis, gross margin was 34 percent, up 11 percentage points from the prior year primarily due to the absence of a $340 million charge (WSA charge) recorded in 2016 associated with an amendment to our wafer supply agreement with GLOBALFOUNDRIES. Operating income was $204 million compared to an operating loss of $372 million in the prior year. The operating income improvement was primarily due to higher revenue and gross margin expansion in 2017, and the absence of the WSA charge recorded in 2016, partially offset by higher operating expenses. Net income was $43 million compared to a net loss of $497 million in the prior year. Diluted earnings per share was $0.04 compared to a loss per share of $0.60 in 2016.

On a non-GAAP(1) basis, gross margin was 34 percent, up 3 percentage points year-over-year primarily due to improved revenue mix from new products. Operating income was $301 million compared to an operating income of $44 million in the prior year. Operating income improvement was primarily related to higher revenue and gross margin expansion, partially offset by higher operating expenses. Net income was $179 million compared to a net loss of $117 million in the prior year. Diluted earnings per share was $0.17 compared to a loss per share of $0.14 in 2016.

Cash and cash equivalents were $1.18 billion at the end of the year, down from $1.26 billion at the end of 2016.

Quarterly Financial Segment Summary

Computing and Graphics segment revenue was $958 million, up 60 percent year-over-year and 17 percent sequentially. The year-over-year and sequential increases were primarily driven by strong sales of Radeon graphics and Ryzen desktop processors.

? Operating income was $85 million, compared to an operating loss of $21 million in Q4 2016 and operating income of $70 million in Q3 2017. The year-over-year and sequential improvements were primarily driven by higher revenue.

? Client average selling price (ASP) was up year-over-year driven by higher Ryzen desktop processors ASP. Client ASP was flat sequentially.

? GPU ASP increased year-over-year and sequentially due to higher desktop and professional graphics ASP.

Enterprise, Embedded and Semi-Custom segment revenue was $522 million, up 3 percent year-over-year driven by server revenue. Sequentially, revenue decreased 37 percent driven by seasonally lower semi-custom SoC revenue.

? Operating income was $19 million compared to $47 million in Q4 2016 and $84 million in Q3 2017. The year-over-year decrease was primarily due to the absence of a $31 million licensing gain in Q4 2016 and an increase in R&D expenses, partially offset by the benefit from a richer product mix. The sequential decrease was primarily due to seasonally lower semi-custom SoC revenue.

All Other operating loss was $22 million compared with operating losses of $29 million in Q4 2016 and $28 million in Q3 2017. The year-over-year and sequential improvement was primarily related to lower stock-based compensation charges in Q4 2017.

Recent Corporate Highlights

AMD expanded its presence in the datacenter with new AMD EPYC? processor-powered solutions and deployments:

? Microsoft Azure became the first global cloud provider to deploy AMD EPYC processors in its datacenters for its latest L-Series of Virtual Machines.

? Baidu deployed AMD EPYC single-socket platforms to power its AI, big data, and cloud computing datacenters.

? New high-performance platforms powered by AMD EPYC CPUs are now available from ecosystem partners including ASUS, GIGABYTE Technology, and Supermicro.

? The AMD EPYC processor-powered HPE ProLiant DL385 Gen10 server started shipping in volume in December 2017, which launched with record-setting SPEC CPU® performance and features leadership cost per virtual machine configurations.

? EPYC CPUs were recognized as the Linley Group Analysts’ Choice Awards “Best Server Processor” and in the “Top 5 Products or Technologies to Watch” category of both the HPCWire Readers’ Choice and Editors’ Choice Awards.

AMD continued its commitment to bring innovation and competition to every segment of the PC market with the launch of its Ryzen Mobile Processors with Radeon Vega graphics, including the AMD Ryzen? 7 2700U processor – the world’s fastest processor for ultrathin notebooks.

? Combining the power of the “Zen” CPU and “Vega” GPU architectures, Ryzen mobile processors deliver up to 3x the CPU performance, up to 2.3x the GPU performance, and up to 58 percent less power consumption compared to the previous generation AMD notebook processors.

? Ryzen mobile-based notebooks are currently available from Acer, HP, and Lenovo, with more systems expected from Dell and other OEMs in Q1 2018.

? AMD and Qualcomm announced a collaboration to bring smooth and fast PC connectivity based on Qualcomm® Snapdragon? LTE modem solutions to high-performance AMD Ryzen mobile processors designed for consumer and enterprise notebooks.

At CES 2018, AMD announced details for upcoming computing and graphics products including its first 7nm product, a Radeon “Vega” GPU specifically built for machine learning applications, as well as next-generation Ryzen CPUs and desktop Ryzen APUs.

Momentum around AMD’s next-generation “Vega” graphics portfolio continues to build:

? Apple launched its most powerful Mac ever, the iMac Pro featuring AMD Radeon Pro Vega graphics.

? AMD designed a semi-custom GPU that will be integrated into the 8th Gen Intel® Core? processor with Radeon RX Vega M Graphics.

? AMD announced the expansion of the “Vega” family with the Radeon Vega Mobile GPU for ultrathin notebooks.

AMD released a major update to its advanced GPU software suite for Radeon graphics, the Radeon Software Adrenalin Edition.

AMD announced the appointment of Mark Durcan to its board of directors.

AMD expanded its leadership team with the appointment of graphics industry leaders Mike Rayfield as senior vice president and general manager of AMD Radeon Technologies Group (RTG) and David Wang as senior vice president of engineering for RTG. Rayfield will be responsible for all aspects of strategy and business management for AMD’s consumer graphics, professional graphics, and semi-custom products. Wang will be responsible for all aspects of graphics engineering, including the technical strategy, architecture, hardware, and software for AMD graphics products and technologies.

Current Outlook

AMD’s outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under “Cautionary Statement” below.

For Q1 2018, AMD expects revenue to be approximately $1.55 billion, plus or minus $50 million, an increase of 32 percent year-over-year, primarily driven by the strength of the ramp of new Ryzen, GPU and EPYC products.

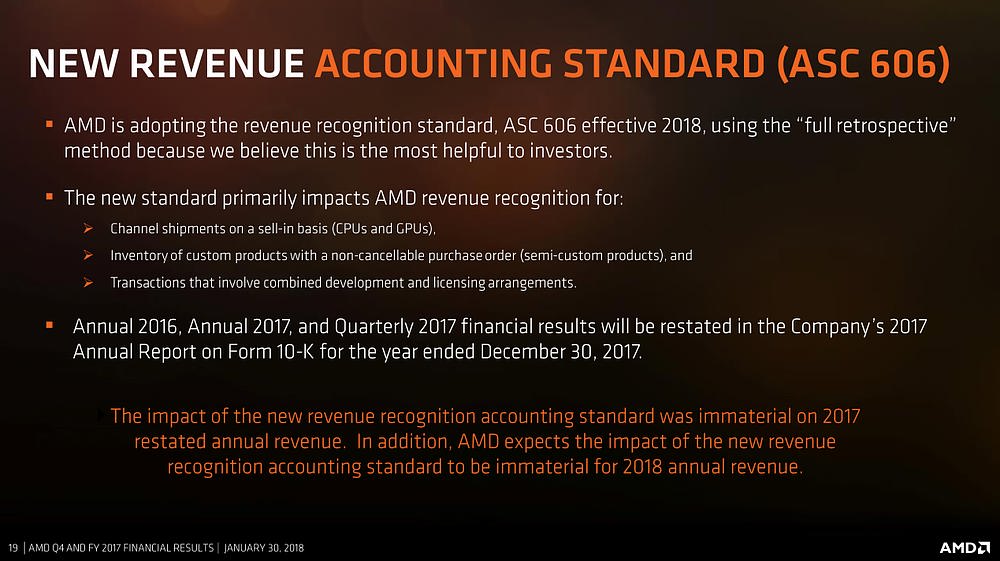

Guidance for Q1 2018 and the year-over-year comparison are under the new revenue recognition accounting standard (ASC 606). AMD is adopting the new revenue recognition standard by applying the “full retrospective” method. For comparative purposes under the new standard, Q1 2017 restated revenue was $1.18 billion and Q4 2017 restated revenue was $1.34 billion.

For fiscal 2018, AMD expects the impact of the new standard on revenue to be immaterial.

For additional details regarding AMD’s results and outlook please see the CFO commentary posted on the Investor Relations page at www.amd.com.

本文地址:http://www.moepc.net/?post=4250

via:quarterlyearnings.amd.com

https://www.anandtech.com/show/12378/amd-announces-q4-fy-2017-results

MOEPC.NET编译整理,ER内容为听译。

转载请注明出处。

radeon Instinct 一句没提 几乎可以说宣告失败

@NiceMing:我是说现有三款产品的销售情况

@NiceMing:有提到,没翻译罢了

@剧毒术士马文:原文没看到啊 你这个原文是部分节选?

@NiceMing:原文是PR,并不是ER的全部信息

ER是我自己节选听译的。完整Transcript要等几天。

说起来Vega Nano是鸽了么

@樱:看这样子应该是鸽了

矿工把Vega全部产能都抢走了

出了也是矿工疯抢

苏妈大胜利,截止现在amd已经涨了5个点,市值飙升到136亿!(滑稽)

等一个牛XAPU用miniITX装好了机拿在手里跟同学吹爆

@hangoverfriday508:简单的小愿望

@hangoverfriday508:买个ITX版子+2400G即可

马上就开卖了

new mac pro有两种设计,一种是中塔双gpu,一种是全塔四gpu,还没定下来哪种。amd肯定希望是后一个。而且epyc上mac应该不太容易,苹果不相信

@在amd看大门:不好说吧,Intel的新架构不知道哪年落地,新制程继续卡着

漏洞对苹果冲击也很大(MAC:我GG了)

感觉有理由认为下一代MAC可能会上ZEN架构的东西

@樱:这就不知道了,不是chh大神,万年没有一个爆料,这个还是八手消息。我是希望epyc上mac pro的,比显卡赚得多

@在amd看大门:推测而已,万一成真了呢

我也挺希望MAC上ZEN架构的东西的

@在amd看大门:目前看没戏 苹果跟intel的供货合同目前还没结束 结束之后 我相信苹果会在笔记本上率先采用

只要解决雷电3的问题

服务器增长了2000万美元收入?这是说EYPC?

那么新的游戏卡有消息嘛

毛利率35%,AMD真正的良心企业!Intel毛利率长年62%左右,暴利!

@ayu:推土机的失败造成的份额疯狂缩水,如今性能赶上来不靠性价比抢份额?他朝一日要是真的再次超越Intel,恐怕又会再出一粒FX-62…

@liubeixi:估计咱们是看不到这一天了。。。。。Intel估计在X86这个领域被人超过的机会并不是很大啊

@ayu:讲道理,是不是暴利要看净利率。否则某些技术工种岂不是叫无本生意了?